As financial markets adapt to technological shifts and global uncertainties, one critical investment question remains: Bitcoin or stocks? With both asset classes attracting investors for different reasons—whether it’s the disruptive potential of cryptocurrencies or the time-tested resilience of the stock market—it’s crucial to understand their characteristics, performance history, and risk profiles.

This guide breaks down Bitcoin vs Stocks (or vs broad funds like VOO & VTSAX) with the latest data and trends to help you make smarter investment decisions.

Bitcoin: The Digital Gold

Bitcoin (BTC) is a decentralized digital currency with a capped supply of 21 million coins. It operates independently of traditional financial institutions and is often touted as a hedge against inflation and monetary debasement.

Key Traits:

- 24/7 trading

- High volatility, high potential returns

- Fixed supply and decentralized control

- Store of value narrative akin to gold

Stocks: Ownership in the Real Economy

Stocks like VOO (which tracks the S&P 500) and VTSAX (a total stock market fund) represent ownership in real-world businesses. They grow through innovation, consumer demand, and economic expansion.

Key Traits:

- Backed by underlying companies with earnings

- Dividend potential

- Heavily regulated and historically stable

- Ideal for long-term compounding and retirement savings

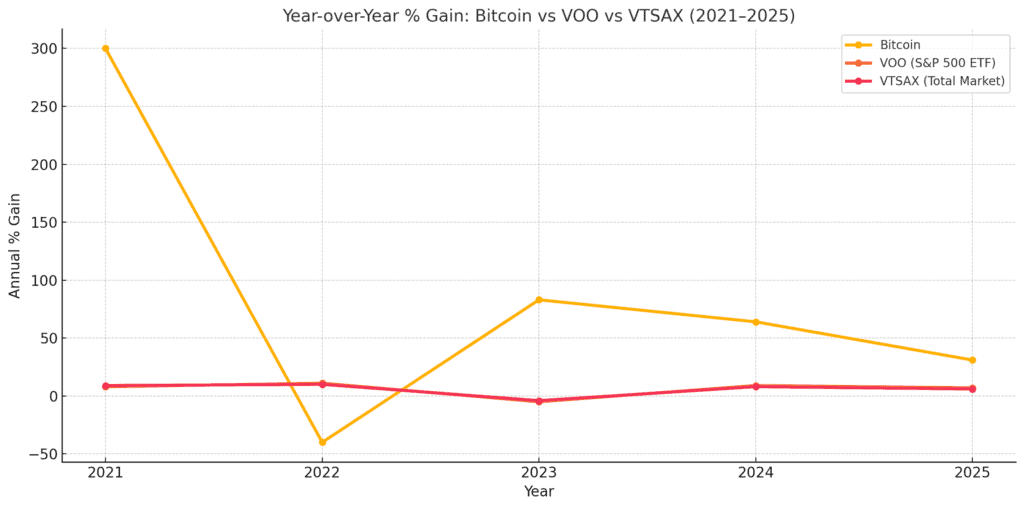

Year-over-Year % Gain Comparison (2021–2025)

One of the clearest ways to evaluate asset performance is to look at annual gains. Here’s how Bitcoin, VOO, and VTSAX have stacked up in the last five years.

Key Takeaways:

- Bitcoin saw extreme highs and lows—highlighting its speculative nature.

- VOO and VTSAX maintained a steadier trajectory, with modest drawdowns.

- Crypto volatility remains significantly higher, but so does upside potential.

Which Is Better for You?

Choose Bitcoin if:

- You can stomach high volatility.

- You want exposure to disruptive technology.

- You’re looking for potentially outsized returns.

Choose VOO/VTSAX if:

- You prefer slow and steady growth.

- You value regulatory protections and historical reliability.

- You’re investing for retirement or stable wealth building.

Consider a Hybrid Strategy

Many investors find balance by combining both asset classes. For instance, a 90/10 split (stocks/Bitcoin) provides diversification without overexposing you to crypto volatility.

Final Verdict

Both Bitcoin and stocks have their place in a well-rounded investment strategy. The right choice depends on your risk tolerance, time horizon, and financial goals. Whether you’re bullish on blockchain or believe in America’s corporate engine, understanding the strengths and weaknesses of each asset class is essential in 2025.

Read Next : Coinbase or Crypto.com